Our Performance in 2024

In 2024, we demonstrated resilience in execution despite facing macroeconomic and regional challenges. The One Weatherford team reinforced our focus and commitment to creating value for shareholders, all while maintaining our path of transformative performance in both financial and operational areas.

-

Financial Performance

In recent years, Weatherford has made substantial progress in strengthening the balance sheet by repaying more than $1 billion of debt, reducing interest expenses by over $100 million, expanding the credit facility, lowering the net leverage ratio*, and achieving industry-leading return on invested capital (ROIC*). These efforts have positioned the Company well for the next chapter of our capital allocation journey.

In 2024, we announced a comprehensive capital allocation framework that includes:

- Improved through-cycle resilience from a strong balance sheet;

- Business investments in technology and infrastructure upgrades to drive portfolio differentiation and structural cost efficiencies resulting in improved returns;

- Strategic mergers and acquisitions that align with our portfolio strategy; and

- A shareholder return program was introduced with an expected annual dividend of $1 per share and an authorization for a share repurchase program of up to $500 million over three years.

This framework reflects Weatherford’s commitment to creating long-term value for shareholders.

*This is a non-GAAP financial measure. Please refer to the appendix below included herein for a reconciliation of GAAP to the non-GAAP financial measures.

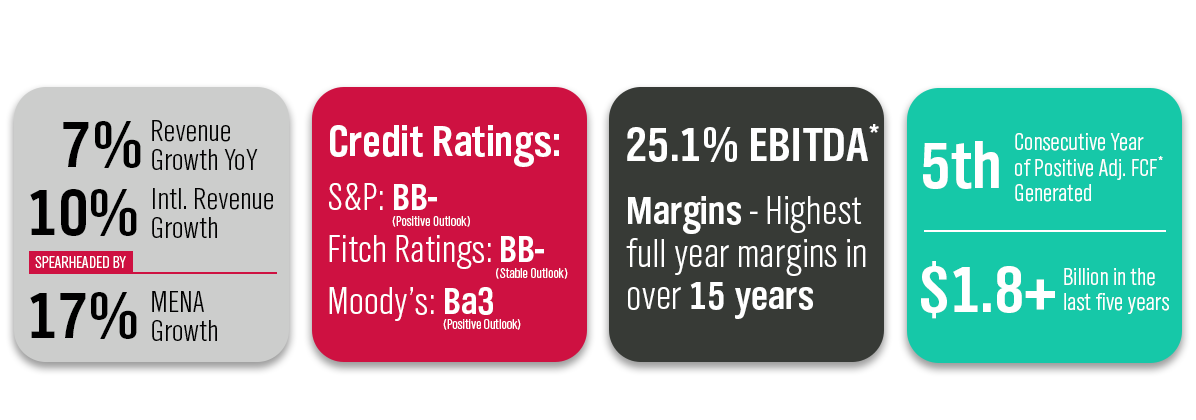

2024 Financial Highlights

- Full-year revenue of $5,513 million, increased 7% from the prior year, driven by international revenue growth of 10%

- Full-year operating income of $938 million, increased 14% from the prior year

- Full-year net income of $506 million, a 9.2% net income margin, increased by 21% from the prior year

- Third consecutive year of positive net income–the first time in over 14 years and the highest level since 2008 (excluding the gain from bankruptcy emergence)

- Full-year adjusted EBITDA* of $1,382 million, a 25.1% adjusted EBITDA margin,* increased 17% and 197 basis points from the prior year – Highest full-year adjusted EBITDA margins* in over 15 years

- Full-year cash provided by operating activities of $792 million and adjusted free cash flow* of $524 million – generated >$1.8 billion of adjusted free cash flow* over the last 5 years

- Net leverage ratio* of less than 0.5x, our lowest level in over 15 years

- Top-tier return on invested capital ROIC* of 26.2% and ROA of 9.9% in 2024

- 2024 Credit Ratings:

- S&P: BB- (Positive Outlook)

- Fitch: BB- (Stable Outlook)

- Moody’s: Ba3 (Positive Outlook)

*This is a non-GAAP financial measure. Please refer to the appendix below included herein for a reconciliation of GAAP to the non-GAAP financial measures.

2025 Tactical Focus Areas

In addition to our Strategic Priorities, we have identified three Focus Areas for 2025, each contributing to our long-term goals and ultimately aligning with our broader strategic objectives:

Structural Cost: We have launched a comprehensive cost optimization program that is focused on driving sustainable productivity improvements through technology and LEAN processes. While this initiative is designed to deliver long-term efficiencies over the coming years, considerable short-term benefits will be visible as these enhancements to our processes and systems begin to take effect.

Net Working Capital* (NWC*) Efficiency: Although there has been a significant improvement in our NWC* efficiency over the past five years, we believe there are immediate opportunities to sustainably reduce NWC* costs as a percentage of revenue to below 25%. Some of these initiatives focus on invoicing, collections, inventory strategies, supplier terms, and manufacturing and repair cycle times. These enhancements will contribute to our goal of achieving adjusted free cash flow conversion* of approximately 50% over the next few years.

Growth Vectors: In a softer market environment, fostering growth will be a key priority. To this end, we have identified specific Growth Vectors that are receiving focused attention. These include targeted initiatives within some of our leading product lines and expanding our digital offerings. Each of these areas is supported by a strong track record, a compelling value proposition, and significant opportunities for future growth through progressive market penetration.

*This is a non-GAAP financial measure. Please refer to the appendix below included herein for a reconciliation of GAAP to the non-GAAP financial measures.

-

Organizational Vitality

At Weatherford, we are committed to ensuring that employees feel valued, empowered, and engaged. We recognize that our people are the foundation of our success, and we prioritize creating an environment where every individual can grow, contribute, and feel appreciated. We incorporate programs, such as our Employee Resource Groups and unconscious bias training, along with other Human Resources and Compliance initiatives, designed to support individual development while creating a workplace where everyone has the opportunity to thrive. In 2024, we welcomed team members from four acquired companies, and we have thoughtfully focused on integrating them into the Weatherford operating structure and culture.

In our pursuit of delivering industry-leading service, we remain dedicated to the development of our talent. Leadership growth is a cornerstone of our approach, and we prioritize this development at every level of the organization–from our NextGen Field Engineering Program to our seasoned leaders. We are committed to nurturing employees who inspire excellence and drive results.

By investing in our workforce and fostering a culture of continuous growth, we are preparing for the challenges of tomorrow. For example, in 2024, we launched a Human Capital Management platform designed to deliver a contemporary employee journey. This modern, scalable software will be used enterprise-wide and brings together employee-focused resources into an intuitive single platform.

-

Customer Experience

This year, we earned several commercial awards across all our segments, recognizing our strong partnerships with customers such as Saudi Aramco, ADNOC, PDO, Equinor, ENI, Chevron, Shell, PTTEP, and others. Additionally, we continued to showcase the depth and strength of our portfolio, achieving significant milestones in technology with major customers. These included the successful installation and inflow testing of the ISO Ultra Extreme well barrier, the deployment of the first Reclaim™ Thru-Tubing P&A Solution and Abandon system in US land operations, and the continued expansion of MPD technology in complex exploration and geothermal wells in the Middle East.

We launched a range of innovative technologies designed to deliver maximum value at every stage of the well lifecycle. Included among these were MARS™, Reclaim, and ForeSite® Edge 2.0. The integration of our digital offerings and our ability to provide integrated solutions across our segments will remain a key driver of growth in our core operations, positioning us to continue meeting the evolving needs of our customers.

-

LEAN Operations

In 2024, we advanced our LEAN transformation, achieving significant efficiency gains, cost savings, and operational improvements across our global sites. Through targeted investments in employee training, Weatherford enhanced problem-solving capabilities, optimized processes, and strengthened the cultural adoption of LEAN principles.

Key initiatives in throughput (T-put) and cycle time reduction led to notable productivity improvements, significantly decreasing process lead times across business units. At the same time, global site optimization efforts streamlined workflows, increased capacity without additional headcount, and reduced costs. By implementing process-oriented layouts and resource-sharing strategies, Repair and Maintenance improved overall productivity while maintaining a LEAN operational structure.

These enhancements resulted in tangible financial benefits, reinforcing the company’s commitment to continuous improvement, including a five day reduction in Net Working Capital* days YoY, driven by better working capital management. We continue to drive performance in operational improvements, efficiencies across billings, collections management, and inventory management. Our full year CAPEX of $299 million represented 5.4% of revenue, slightly above the guided range of 3-5%. Every dollar of CAPEX incurred is rigorously monitored and focused towards providing incremental returns for the business. A LEAN-focused Strategic Deployment Process was instituted across our largest projects to institute stage gates and management review, which has increased efficiency. Along with LEAN Operations, a LEAN balance sheet serves as an effective platform for business growth and efficient capital allocation. In 2024, our current net leverage* stands at 0.48x, the lowest position in more than 15 years. All our efforts towards building an asset-light business have resulted in top-tier ROIC* of 26.2%. We will continue our initiatives of fulfillment and directed growth to achieve a more robust growth on a well-monitored OPEX and CAPEX base.

- >340 basis points improvement in overhead costs as a % of revenue 2024 vs. 2022

- 5 days reduction in NWC* performance 2024 vs. 2023

*This is a non-GAAP financial measure. Please refer to the appendix below included herein for a reconciliation of GAAP to the non-GAAP financial measures.

-

Creating the Future

Our final priority is creating the future. Innovation is the key tenet to achieving this objective. Our focus will be to enable our people to understand the needs of our customers and to introduce new products and services that create a unique value proposition for our customers and differentiate us in the market. Through strategic investments in technology differentiation and targeted acquisitions, including the successful integration of Datagration, Ardyne, Probe, and Impact Selector International, we have expanded our portfolio and continue to drive innovative technology solutions that deliver significant value to our customers.

Looking ahead to 2025, we will continue to actively engage in further building our core products and services, energy transition and digital portfolios, thereby positioning ourselves for the next decade. As a responsible organization that is committed to its sustainability journey, Weatherford will continue to advance our ESG strategies and collaborate with stakeholders to achieve our commitments.

AU24

AU24